I went on a search to find the cheapest massage insurance.

I found it.

But deciding on which massage insurance to buy is not as straightforward as finding the cheapest.

Many organizations bundle massage insurance in with membership.

Membership comes with bonuses, like “free” massage CEs, but surprise, surprise, bundled packages typically cost more.

Hmm…paying a little more to get “free” CE courses sounds good…but wait, renewal is every 2 years (if you’re in PA)…should I pay a little more to get “free” CEs every year?…am I really saving money?…and what if I hate the CE courses…oh, but then they also give me “free” scheduling software…that’s cool stuff, but when I did the demo, I know that I’m gonna wanna upgrade and that’s gonna cost more…wait do I have to attend meetings if I become a member?…I like the idea of a “free” website, but why does my domain name say www.markliskey/XYZ .org?…I’ll be right back…

Aaaaahhhh!!!!

Take a deep breath in. We can get through this.

These Are the Good Old Days

Remember the good old days when you just bought cheap massage insurance and that was it?

No “free” websites that never get noticed.

No newsletters that you never read.

No upselling you scheduling software and massage business services.

No massage insurance the next year because the company you bought from vanished into thin air…

Okay, so it wasn’t all that great.

The reality is, we’ve got a lot of choices now.

We just need to wade through them–and that’s what I’m going to help you do.

Before we get started please note that some of the links below are affiliate links. That means I get a commission if you purchase through an affiliate link. But you don’t pay more for going through my links.

Affiliate commissions help keep this blog cranking, and thank you if do choose to support my work.

My goal with this article is simply to give you the spreadsheets so that you can compare policies. You make the decision regarding who you want to go with.

Lastly, if you have a massage insurance liability question for any company mentioned in this article, send it to me. I will make sure that you get an answer.

Sound good?

Alright, let’s get crackin’.

Here’s What I Did to Find the Cheapest Massage Insurance

To make things easier, I divided up the many massage insurance options into two categories: Just Insurance and Insurance with Extras.

Here’s what a Google search turned up for the Just Insurance options.

Just Massage Insurance

a. $96/year: Beauty & Bodywork Insurance (BBI)

b. $97/year: Insure LMT

c. $99/year: American Massage Council

Here are the Insurance with Extras options.

Massage Insurance with Extras

a. $165/year: Hands On Trade

b. $155/year: Insure LMT

c. $169/year: Massage Magazine Insurance Plus

d. $179/year: NACAMS

e. $199/year (and $229/year): ABMP

f. $204.99/year: NAMASTA [$99.99 (associate membership) + $105 (insurance)]

g. $269/year: Alternative Balance

h. $235/year: AMTA

In this category there are 8 options.

Now let’s compare the options in Just Insurance.

I Just Want Freakin’ Masssage Insurance

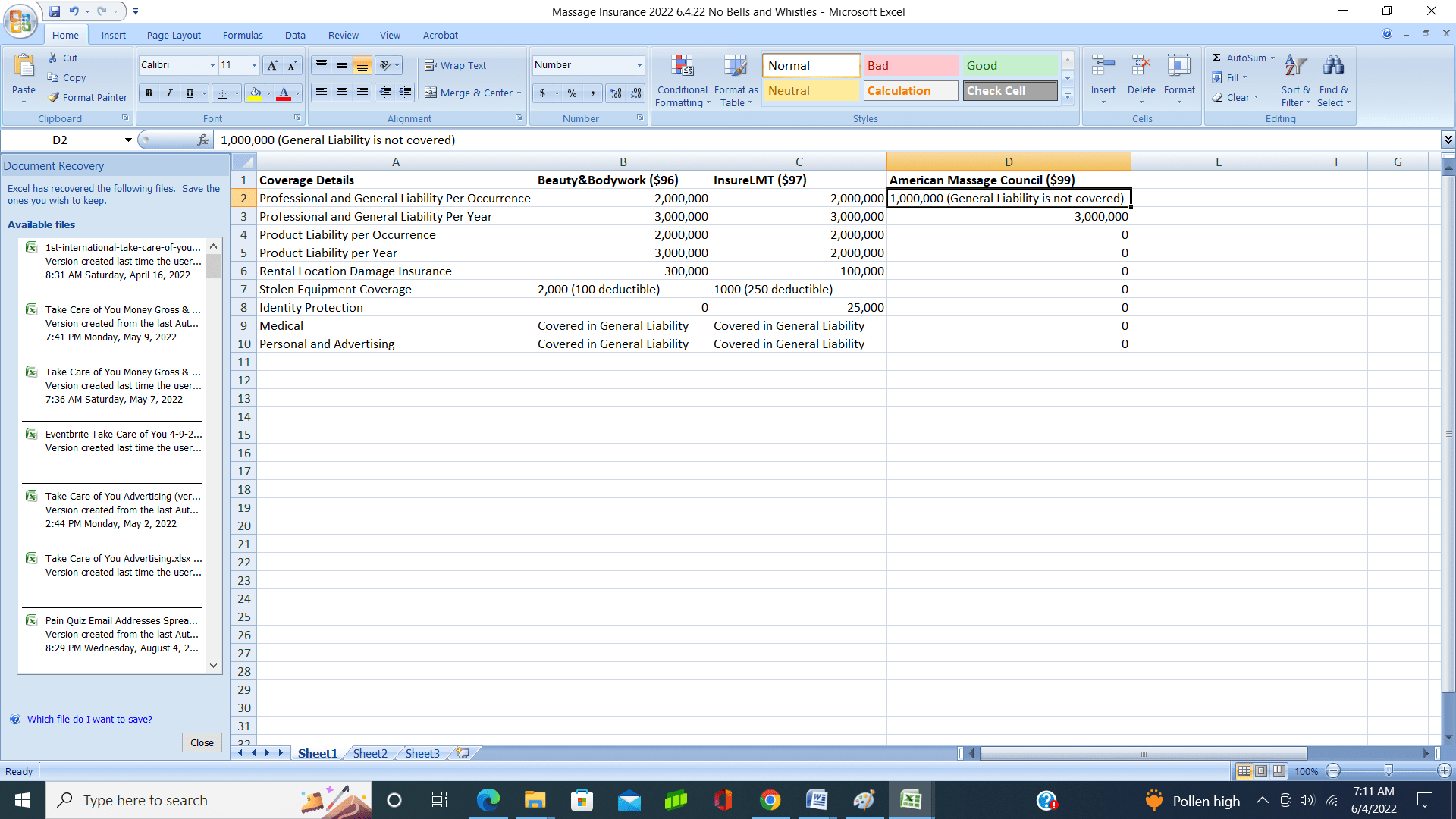

Here’s what the 3 options for Just Insurance look like on a spreadsheet:

Immediately you see that the American Massage Council’s policy is lacking in 8 out of 9 categories when compared to Beauty & Bodywork and InsureLMT.

In 5 out of 9 categories, both Beauty & Bodywork and InsureLMT provide the same coverage amount. Of the 4 remaining categories, Beauty & Bodywork wins: 3 (win) -1 (loss).

So, Beauty & Bodywork is a $1 cheaper than InsureLMT and is better than InsureLMT in 3 categories.

Right now it looks like: Go with Beauty & Bodywork if you just want the cheapest insurance with the best “category” (the categories I compared above) coverage.

But there is one more thing to consider and it’s this:

Beauty & Bodywork liability insurance is a claims-made policy.

InsureLMT is a occurrence-Form policy.

Huh?

Yeah, well let’s Allen Financial Insurance Group (https://www.eqgroup.com/occurrence_claimsmade_explained/) explain it.

An occurrence policy “provides coverage for ‘alleged incidents’ (injuries) that happened during the policy year regardless of when the claim is reported to the carrier. It provides a separate coverage limit for each year the policy is in force. It doesn’t matter if the policy is active when the claim is reported. It only matters that the policy was active when the alleged incident occurred.”

A claims policy covers the insured for an incident that occurred during the policy period and was reported as a claim while the policy remained in force.”

Huh?

I’m with ya. Let’s put it in massage language.

A Claim Happens

You have an occurrence massage liability policy.

Kyle, a client, trips over your massage stool and breaks his wrist when the policy is in effect (while you have the occurrence insurance).

The next year you buy a different massage liability policy and that next year Kyle makes a claim.

No problem because you’re covered under the occurrence policy that you had the year before even though you no longer have that policy.

Now, say you had a claims-made policy when Kyle tripped and broke his wrist. But the next year (the year Kyle makes a claim) you had a different insurance policy.

Guess what?

You’re not covered because the claim was made when your claims-made policy was not in effect.

In the Kyle scenario in order to be covered with a claims-made policy you would have had to renew your claims-made policy the year Kyle reported a claim.

Important stuff to know, but not the end of the world, right?

BBI winner of the 9 category battle is a claims-made policy.

Always renewing each year with them would solve the claims-made policy challenge.

If you don’t want to think about insurance that much go with InsureLMT for $1 more.

Insurance with the Bells and Whistles

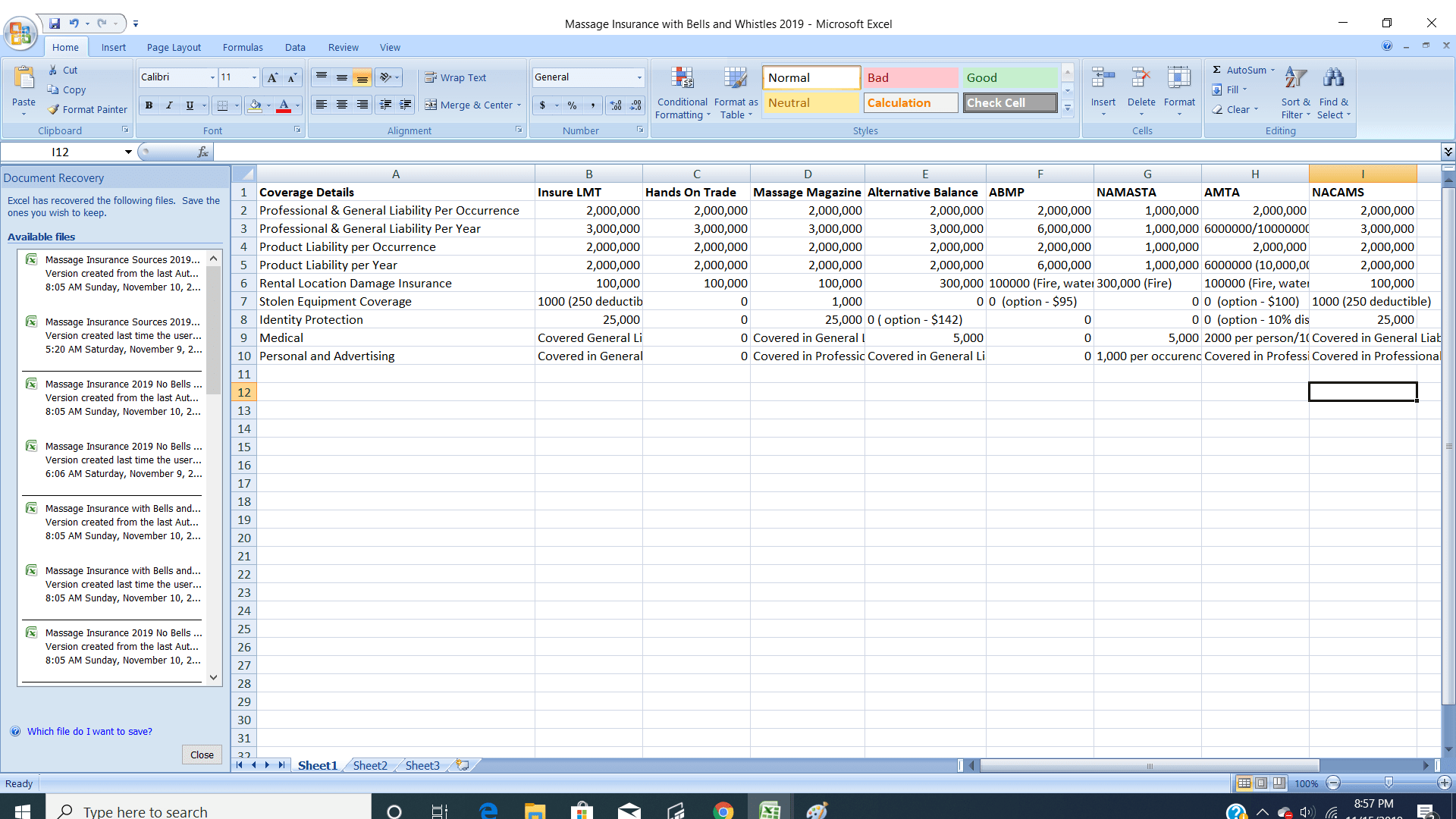

Take a look at the spreadsheet:

A quick glance reveals that in categories 1 – 5 all options are fairly comparable except for NAMASTA. Their numbers are the lowest.

Also, worth noting is that the ABMP and AMTA have the best numbers in categories 1 – 5.

Let’s look at categories 6 – 9. HandsOnTrade scores the worst. And ABMP, AMTA and NAMASTA have goose eggs in two out four categories.

NAMASTA is looking a little rough here. We’ll come back to that a little later.

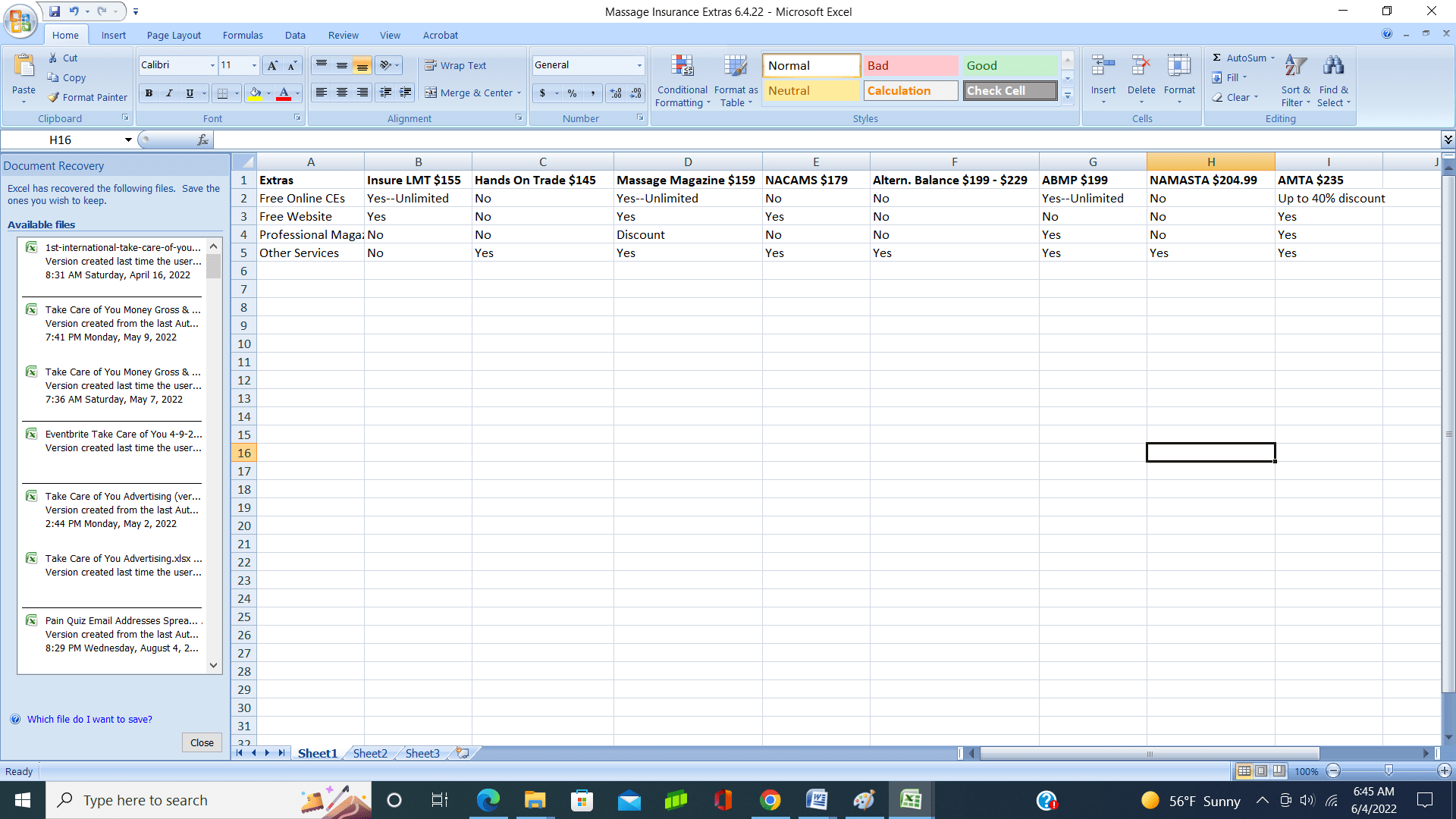

But what about added value? Here’s a spreadsheet of the extras you get with each option.

At this point, if I were leaning towards buying insurance through a professional organization, I’d look at the column that is labeled “Extras” and decide which extras are important to me.

Once you decide what’s important to you, it will be easier to select a professional organization that meets your needs.

Free Websites Don’t Work

Okay, I have to say something here.

Okay, I have to say something here.

If you’re jacked about the free website you’re going to get with your insurance, don’t be.

It will be as generic as vanilla ice cream and your URL will be unprofessional and make the client wonder if you can afford sheets.

Build one yourself.

It’s not expensive (as cheap as $60/year to start). Click here.

Okay, back to the business of picking insurance.

Massage Insurance Bundle Deals

You might be wondering if a bundle deal through a professional organization could save you money via the bonuses and perks.

Good question.

Two Insurance with Extras options stand out here. InsureLMT ($155) and Massage Magazine Insurance Plus ($169) because they both offer unlimited online CEs and have solid insurance. Massage Magazine Insurance Plus also throws in $500+ in industry discounts and a discount on their magazine called Massage Magazine.

But before you whip out your Visa, here’s something to think about…is buying an insurance option with unlimited CEs cheaper than buying BBI at $96 of InsureLMT policy at $97 and getting your CEs elsewhere?

Well, today I found 12 online CEs for $49. So, the answer would be you if you want the absolute, cheapest massage insurance and an online CE combo then buying an insurance policy with no bells and whistles and finding a cheap online CE provider can save you a little bit of money.

But if you want cheap, no hassles and unlimited CEs always at your disposal, go with Massage Magazine or Insure LMT insurance with extras.

It’s Not Always About the $

But buying insurance through a professional organization isn’t always about money, right?

Sometimes it’s about category 4–“Other”. In other words, it’s about having the support of a professional organization.

For a deeper dive into “Other”, here are the links to the additional perks with each option. I’ll see you in the paragraph after the links. (Oh, warning: when you see the word “access”, that usually means you have access to something that you’ll have to pay for.)

How’d it go? Did one organization resonate with you? If so, maybe that’s the one to buy from. But before you do, let’s do a quick review.

My Massage Insurance Cautions

These massage insurance options fell significantly short of their competitors.

In the Just Insurance category, the American Massage Council insurance coverage was the weakest

And NAMASTA fell behind the rest of the pack in the Insurance with Extras category.

But if you liked the extras NAMASTA offers, you could become a member (and get the extras) without buying the massage insurance from them.

And in Conclusion…

Does it seem like it’s getting complicated again?

Let’s un-complicate it.

Do you want inexpensive insurance?

If so, go with Beauty & Bodywork ($96) or InsureLMT ($97).

Do you want inexpensive insurance and “free” CEs?

Then go with InsureLMT ($155 with unlimited CEs) or Massage Magazine Insurance Plus ($169 with unlimited CEs and the massage industry discounts).

Do you want the support of a professional organization?

Decide which organization has the perks that are best for you. And if at the end of a year, it turns out to be a bad fit, you can always switch to another option.

It’s your hard-earned money.

Spend it where it makes the most sense for your needs.

Free Stuff

If you’re trying to build a massage business without spending a lot of money, this free program will help you out: Jumpstart.

Check out more ways I save money on my resources page.

Catch my weekly info for free.

Just sign up to be in my email group.

P.S. Here’s a list of insurance terms and definitions to use as a reference. It’s taken from the HandsOnTrade website. I made one edit.

Also, if you want to connect to my email list, sign up below.

I’ll send you my latest articles, videos, tutorials, and downloads to help you make more money, build a practice and stay pain- and injury-free.

Insurance Terms

Claims Made Policy

Occurrence Based Policy

Insurance that pays claims arising out of incidents that occur during the policy term, even if they are filed years later or if the policy is no longer in effect.

Malpractice

Professional misconduct or lack of ordinary skill in the performance of a professional act which renders the practitioner liable for damages.

Professional Liability Insurance

The obligation that a professional practitioner has to provide care or service that meets the standard of practice for his/her profession.

General Liability Insurance

A form of insurance designed to protect practitioners from liability exposures arising out of accidents resulting from the premises.

Product Liability Insurance

Insurance on a professional practitioner from suits arising out of damage caused by a product used on a client.

Damage to Premises

Property Damage to any one premises while rented by the Insured or in the case of damage by fire, while rented by the Insured or temporarily occupied by the Insured with permission of the owner of premises.

Per Occurrence limit

This is the limit for all damages, whether property damage or bodily injury resulting from one occurrence.

Aggregate limit

This is the maximum limit for all claims against you during the policy period. Each claim paid reduces the remaining coverage for the period until the aggregate amount is paid.

Comments on this entry are closed.

Thank you so much! Last-minute shopping for insurance (have had my license for a while but just decided to pick up gigs now that I’ve quit my desk job) and this is very helpful!

Hey Rae, glad you found it helpful! Let me know if there is anything else I can help you with!

Hello Mark .. Ty for this very detail oriented and informative website .. I was hoping you could clarify something on the 1st spreadsheet .. “No Bells and Whistles” .. Row #9 has a heading that says MEDICAL and it shows that BBI Company has zero .. I called BBI and asked about their medical coverage .. they said if a patient gets injured while at your place or in your care we will cover their medical expenses up to the 2 million per occurrence .. Mark I’m confused, can you please explain your meaning of the word MEDICAL in Row #9 ?

Hey T-man, thanks for the question. I appreciate your diligence. The column that says MEDICAL (Row #9) refers to Medical Expenses. I’m defining medical expenses as “Coverage that reimburses others, without regard to the insured’s liability, for medical or funeral expenses incurred by such persons as a result of bodily injury or death sustained by accident under the conditions specified in the policy. This does not apply to the named insured or their employees.” (I’m using the definition given on the Alternative Balance Website, https://alternativebalance.net/coverage_cost).) So, MEDICAL in row #9 does not stand for a medical expenses maximum amount that will be covered if someone gets injured at your place. Sorry for the confusion. I will be updating this article soon to reflect any changes with insurance providers and I will provide more clarification with the terms then. Thanks!

I am happy to hear the part about updating your website soon with more clarification .. because the explanation you just wrote is still very confusing .. what I understand is BBI offers zero coverage for something medical .. but I still unsure sure what that something is .. is it funeral expenses ?

Sorry to leave you hanging, T-man. As it was explained to me, the key thing is who’s at fault. When you’re at fault, medical expenses, etc. are usually covered in the general liablity coverage. If you look at the spreadsheets, all companies cover this including BBI (at the 2 million per occurence that you had mentioned). When you’re not at fault (e.g., someone slips in the parking lot and comes after your business because it happened in the parking lot but the accident is not directly related to you) that is covered under the category of medical expenses. At the time of the blog post I had called the insurance providers and/or professional organizations that sold the insurance to see if medical expenses (without regard to fault) were covered in their policies if not stated on their websites. Not sure if there was a miscommunication with BBI or BBI added medical expenses more recently to their policy, but it turns out that BBI does cover $5,000 per incident. So, I will be updating the spreadsheets and article soon. Great question and comments. Thank you. It all helps me with clarifying and simplifying when I do the update.

Ahhh, just what I was looking for. Added perk that you broke down the CEs for PA!! Much love, thanks!!!

Hey, Jen! Glad the article was helpful. Let me know if there’s something else you need more info about. Take care!

Thanks for the info and breaking it down in an approachable way. It can be a little overwhelming, but this really eased my mind! Best of luck with your business!

Hey Eric, I’m glad the article helped you out! Good luck, and I’ll be here if you need more info and/or help with massage stuff:-)

Thank you for this! I relocated and just received my Georgia license and was trying to figure out which policy to go with…you helped me make that decision, so thanks! 🙂

Hey, I’m glad that I could help you out! Good luck and let me know if there is another topic that you’d like more information about.

Any recommendations for malpractice, liability insurance for bio-magnetic pair therapy practitioners? Also, I’m looking for advice re. crafting a hold harmless agreement, for clients to sign.

Hey, Lee! I’m not sure about liability insurance for biomagnetic therapy, but I’ll look into it and get back to you.

Regarding a hold harmless agreement, the AMTA provides a sample here: https://www.amtamassage.org/career_guidance/detail/102?typeId=3

And here’s an example from the ABMP: https://www.abmp.com/members/pdfs/client_information.pdf

Hopefully, they will help as you re-craft your hold harmless agreement.

I’ll let you know what I find about liability insurance for biomagnetic therapy.

Thanks for the useful breakdown! Readers should note: BBI does NOT cover cupping–definitely not wet (heat/blood-drawing), but not even dry; they charge extra for it. So, the $96 suddenly becomes over $130. ILMT is a lot more comprehensive from that perspective.

Thanks for the information about the difference between BBI and ILMT insurance coverage for cupping! That’s really helpful to know and important to consider even if cupping is only a minor treatment therapy in one’s massage regimen.